Dewatering Liner Market in APAC, Europe, and USA to Reach USD 2.8 Billion by 2035, Driven by Expanding Wastewater

The dewatering liner market grew steadily, driven by sludge management regulations and industrial effluent control mandates.

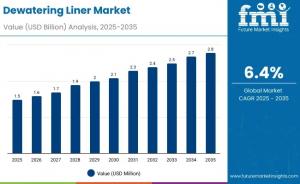

NEWARK, DE, UNITED STATES, November 10, 2025 /EINPresswire.com/ -- The global dewatering liner market is set to undergo significant expansion over the next decade, growing from USD 1.5 billion in 2025 to USD 2.8 billion by 2035, reflecting a robust compound annual growth rate (CAGR) of 6.4%. This growth trajectory is underpinned by increasing wastewater treatment infrastructure, mining expansion, and agricultural waste management initiatives worldwide. As industries and municipalities strive for greater environmental compliance and cost-effective water recovery, polypropylene (PP)-based liners continue to dominate due to their exceptional strength, permeability, and affordability

Market Overview and Growth Outlook

Between 2025 and 2030, the dewatering liner market is projected to gain an additional USD 0.6 billion, driven largely by industrial wastewater treatment and municipal sludge management projects. By 2035, broader adoption across mining, sludge processing, and agriculture will create a USD 1.3 billion opportunity.

Unlock Growth Potential – Request Your Sample Now and Explore Market Opportunities!

https://www.futuremarketinsights.com/reports/sample/rep-gb-27056

From 2020 to 2024, the industry maintained steady momentum, propelled by stricter sludge disposal regulations and industrial effluent control mandates. These trends solidified dewatering liners—especially PP and geotextile types—as key tools for efficient solid-liquid separation.

By 2035, Asia-Pacific and North America will remain global leaders, fueled by municipal modernization initiatives and industrial wastewater treatment investments. The next decade will witness rising adoption of automation and composite liner technologies, enhancing both efficiency and environmental compliance.

Key Market Drivers

• Tightening Environmental Regulations: Governments worldwide are enforcing stricter wastewater treatment and sludge disposal standards.

• Industrial Water Recycling: Industries are turning to liner-based dewatering systems to improve water recovery rates and reduce waste volumes.

• Urban Wastewater Expansion: Growing urbanization drives large-scale investment in municipal wastewater treatment plants.

• Sustainability Push: The industry is gradually embracing biodegradable liners and recyclable PP fabrics aligned with circular economy goals.

These drivers collectively foster market resilience and long-term demand across industrial and municipal sectors.

Segmental Insights

By Material:

Polypropylene (PP) dominates with 37.9% market share in 2025, owing to its superior tensile strength, cost efficiency, and chemical resistance. Continued R&D in UV-resistant and biodegradable PP fabrics will enhance sustainability performance in the coming years.

By Design Type:

Woven liners account for 41.5% of market share, offering high permeability and reusability—critical attributes for sludge and sediment applications. Emerging hybrid woven-composite liners are poised to enhance dewatering efficiency by 2035.

By Capacity:

The 11–25 cubic yard segment leads with 36.2% share, serving medium-scale municipal and industrial operations. Modular designs are gaining traction for compact sludge containment systems.

By Application:

Sludge and sediment dewatering dominates with 39.8% share, driven by modernization in wastewater facilities and dredging projects. Technological advancements such as automated flow control and high-efficiency liners are expected to shape future developments.

By End-Use:

Municipal waste management remains the largest end-use segment with 43.6% share. Expansion of urban water infrastructure in Asia-Pacific and rehabilitation projects in North America sustain this leadership. By 2035, circular waste management frameworks will further extend liner life cycles.

Opportunities, Restraints, and Emerging Trends

While high initial setup costs and limited reuse cycles can hinder adoption in cost-sensitive regions, the market is evolving with biodegradable polymers, IoT-enabled monitoring systems, and composite filtration liners.

Emerging trends include:

• Integration of smart sensors for real-time performance tracking

• Recycled polymer-based liners supporting circular economies

• Development of multi-layer filtration fabrics for enhanced drainage rates

• Expansion of portable dewatering systems for construction and agriculture sectors

Regional and Country-Level Insights

Asia-Pacific:

Leading the global market, Asia-Pacific’s growth is anchored by government-funded wastewater and sludge management programs. Japan and South Korea are at the forefront of innovation, emphasizing automation, biodegradable materials, and smart dewatering systems.

• Japan (6.9% CAGR): Dominated by PP liners (38%), Japan focuses on automation and recyclable polymer technologies, boosting export opportunities in Asia.

• South Korea (7.0% CAGR): A pioneer in smart wastewater projects, the nation is adopting bio-based and multi-layer filtration liners aligned with its green manufacturing strategy.

• China (6.4% CAGR): Industrial growth and government-backed sludge management programs fuel robust demand.

• India (6.3% CAGR): Programs like Namami Gange and Smart City Mission drive wastewater recycling and agricultural waste applications.

North America:

The U.S. market (6.5% CAGR) is buoyed by EPA-driven wastewater modernization and strong industrial effluent treatment demand. Technological innovation in geotextile liners continues to enhance efficiency and compliance in municipal utilities.

Europe:

• Germany (6.2% CAGR): Advanced engineering and EU waste minimization policies promote high-strength geotextile liner adoption.

• United Kingdom (6.3% CAGR): The focus on eco-compliance and landfill diversion drives demand for compact and smart dewatering systems.

Purchase Full Report for Detailed Insights

For access to full forecasts, regional breakouts, company share analysis, and emerging trend assessments, you can purchase the complete report here:

Buy Full Report – https://www.futuremarketinsights.com/checkout/27056

Competitive Landscape

The dewatering liner market is moderately fragmented, with global and regional players focusing on product durability, reusability, and filtration efficiency.

Key companies include:

• Extra Packaging

• PacTec Inc.

• WMG Inc.

• Poly-Corr Industries

• S&C Environmental

• Impact Environmental Group (IEG)

• DumpsterLiners.com

• EnviroZone

PacTec and WMG lead industrial-scale solutions, while IEG and EnviroZone specialize in customized wastewater containment systems. Competitive strategies revolve around layered composite technologies, sustainability, and regional service expansions.

Why FMI: https://www.futuremarketinsights.com/why-fmi

Have a Look at Related Research Reports on the Packaging Domain:

Foil Pouch Packaging Market - https://www.futuremarketinsights.com/reports/foil-pouch-packaging-market

Tear Tape Dispenser Market - https://www.futuremarketinsights.com/reports/tear-tape-dispenser-market

Bi-Injected Snap Hinge Closure Market - https://www.futuremarketinsights.com/reports/bi-injected-snap-hinge-closure-market

Pharmaceutical Plastic Pots Market - https://www.futuremarketinsights.com/reports/pharmaceutical-plastic-pots-market

About Future Market Insights (FMI)

Future Market Insights, Inc. (FMI) is an ESOMAR-certified, ISO 9001:2015 market research and consulting organization, trusted by Fortune 500 clients and global enterprises. With operations in the U.S., UK, India, and Dubai, FMI provides data-backed insights and strategic intelligence across 30+ industries and 1200 markets worldwide.

Sudip Saha

Future Market Insights Inc.

+1 347-918-3531

email us here

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.